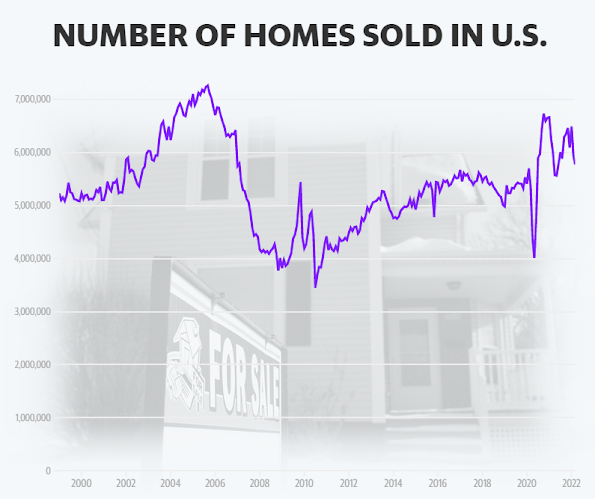

Here are charts relevant to real estate investment; first is the homes sold chart since 2000:

Let's zoom in with the sales chart to year-scale the same as the VNQ one. Bear in mind that the VNQ chart's interval is one month, while the sales chart is sometimes one month but usually two months.

- Continuing high demand,

- Rising interest rates,

- High inflation

- Decreasing supply of homes for sale

Why is the supply decreasing while demand is level? Probably because of millions of homeowners like me. We bought our present home in 2017 with a 3.75 percent mortgage. A year ago we refinanced at significantly less than 3 percent. If we sold our house and bought another one, we'd have a mortgage rate, as of today, of 4.5 percent. If we financed exactly the same amount as remains on our present mortgage, and not one dollar more, the new P&I (only) payment would be $268 more than on our present mortgage, or $3,216 per year. Over, say, a 30-year mortgage that would come to almost $100,000. And with inflation nearing double-digits, would I really want to remove that $3,216 from my disposable income?

What exactly is my - and millions of others' like me - incentive to sell other than from actual necessity? Maybe downsizing could be an answer. Near our house they are building duplex condos for retirees. The starting price for them is about what we paid for our separate house five years ago. Because our house has appreciated 66 percent since we bought it (according to Realtor.com) we could sell our house now and move into a condo, using the equity to pay way down the costs. Problem is, of course, they are significantly smaller and we do not want to downsize so dramatically.

I suspect, though, that a lot of men and women a few years older than my wife and me will do so. But who knows? As I said, I do not think the market has ever had a combination of sustained demand, rising interest rate, skyrocketing inflation, and decreasing supply of existing homes. Builders cannot keep up for many reasons, one of which is enormously increased costs of materials and labor, and another being supply-chain difficulties that are still not wholly resolved. It is a good time, I think, to be content with what we have. And I think millions of other will think the same thing.

I suspect, though, that a lot of men and women a few years older than my wife and me will do so. But who knows? As I said, I do not think the market has ever had a combination of sustained demand, rising interest rate, skyrocketing inflation, and decreasing supply of existing homes. Builders cannot keep up for many reasons, one of which is enormously increased costs of materials and labor, and another being supply-chain difficulties that are still not wholly resolved. It is a good time, I think, to be content with what we have. And I think millions of other will think the same thing.

As for VNQ and similar funds, I would expect its chart to continue to mirror the sales chart, unfortunately.

Update: "Homebuilder confidence falls for fourth straight month -- Sales traffic has declined amid rising prices and interest rates despite low inventory"

"The housing market faces an inflection point as an unexpectedly quick rise in interest rates, rising home prices and escalating material costs have significantly decreased housing affordability conditions, particularly in the crucial entry-level market," said NAHB chief economist Robert Dietz.

Update: And now, just two days after this post, Realtor.com: "Home Prices Have Begun Falling: Here Are the Cities Where They’re Down the Most." Those cities:

Update: A comment on FB at a related post there by a recently-retired homebuilder:

I got out just in time as the cost of building materials is simply insane. One rafter on my last house was almost $100 each. OSB sheathing is almost three times what it was a couple of years ago. People are still building like this is not a problem. Thus existing homes are pricing way up. This last house went for $480k after two days on market with two showings. I have $275k into it three years ago. Sooner or later building material costs will start coming down. At that point, the housing market will implode.