Came across this in my archives. A friend emailed this to me in 2003. It was purportedly by T. Davies, a professor of accounting at the University of South Dakota. I did then confirm, back then, that a man named Tom Davies with accounting credentials taught at the school; whether he was the author of the essay below seems reasonable but not certain. But it is an interesting analogy of the tax systems and tax cuts.

Let's put tax cuts in terms everyone can understand. Suppose that every day, ten men go out for dinner. The bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this: The first four men - the poorest - would pay nothing; the fifth would pay $1, the sixth would pay $3, the seventh $7, the eighth $12, the ninth $18, and the tenth man - the richest - would pay $59. That's what they decided to do. The ten men ate dinner in the restaurant every day and seemed quite happy with the arrangement - until one day, the owner threw them a curve (in tax language, a tax cut).

"Since you are all such good customers," he said, "I'm going to reduce the cost of your daily meal by $20." So now dinner for the ten only cost $80.

The group still wanted to pay their bill the way we pay our taxes. So the first four men were unaffected. They would still eat for free. But what about the other six men who actually pay the bill? How could they divvy up the $20 windfall so that everyone would get his "fair share?" The six men realized that $20 divided by six is $3.33. But if they subtracted that from everybody's share, the fifth and sixth man would end up being paid to eat their meal. So the restaurant owner suggested that it would be fair to reduce each man's bill by roughly the same amount and he proceeded to work out the amounts each should pay. And so the fifth man paid nothing, the sixth pitched in $2, and the seventh paid $5, the eighth paid $9, the ninth paid $12, leaving the tenth man with a bill of $52 instead of his earlier $59.

Each of the six was better off than before. And the first four continued to eat for free. But once outside the restaurant, the men began to compare their savings. "I only got a dollar out of the $20," declared the sixth man, but he, (pointing to the tenth) got $7!" "Yeah, that's right," exclaimed the fifth man, "I only saved a dollar too. It's unfair that he got seven times more than me!" "That's true!" shouted the seventh man, why should he get $7 back when I only got $2?" "The wealthy get all the breaks!"

"Wait a minute," yelled the first four men in unison, "We didn't get anything at all. The system exploits the poor!"

The nine men surrounded the tenth and beat him up. The next night he didn't show up for dinner, so the nine sat down and ate without him. But when it came time to pay the bill, they discovered, a little late what was very important. They were fifty-two dollars short of paying the bill!

Imagine that!

And that, boys and girls, journalists and college instructors, is how the tax system works. The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up at the table anymore.

After all, no one is obligated to become a millionaire. I remember attending a ministerial conference where at lunch, another pastor sitting across the table from me said that the income-tax rate should be 100 percent of all income, however received, of more than $1 million. I said nothing, but wanted to point out that all that would do is guarantee that no one would make more than $1 million.

It is a political slogan today that "the rich should pay their fair share." Of course, the politicians saying this never - and I mean never - define what is a fair share except that it always means "more." But here are inconvenient facts:

- The people who have more income per year than 99 percent of Americans - this makes them the fabled one percent - collectively account for 20 percent of all income earned by all Americans.

- So, if they are to pay their "fair share," would that not mean the one percent would pay 20 percent of all federal income taxes?

- But in fact, the one percent pay 40 percent of all income taxes.

- The top 0.1 percent of earners paid 20 percent of all income taxes. That is a greater sum than the bottom 75 percent of all taxpayers.

- "It is hard to say that the tax code is rigged in favor of the rich when more than 53 million taxpayers, more than one-third of all taxpayers, have no income tax liability because of the numerous credits and deductions that have been created or expanded in recent decades." And the number of Form 1040 filers who have zero tax to pay has increased from 23.6 percent in 1997 to to more than 34 percent today.

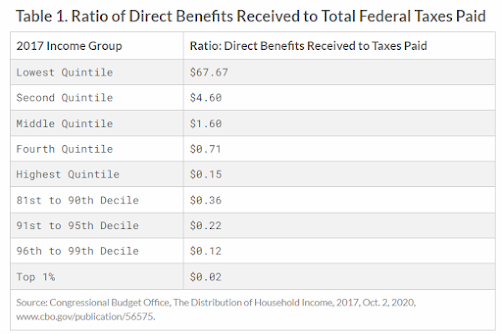

Then there is the question of the value of federal benefits tax filers receive in comparison to the amount of tax they pay. Or, for every $1 a tax payer pays, what is the value of federal benefits received? And here is the answer:

The CBO data indicates that redistribution reduced the incomes of households in the top 1 percent by more than one-third, while lifting the incomes of households in the lowest quintile by 126 percent, those in the second quintile by 46 percent, and those in the middle quintile by 10 percent. Those are the results that you would expect from a highly progressive fiscal system.

I am not saying this is wrong. I am saying that anyone who claims that the rich (which of course, always means "other people") should pay their fair share might want to understand what their share is to begin with.

BTW, over the years in no few discussions with others about this topic, I have asked the "fair share" proponents whether they thought they, themselves, personally paid too little in taxes. In other words, I challenged them to say whether they were personally paying their fair share. Not one progressive has ever answered that they thought their own tax rate should be increased. It was always other people whom they demanded be taxed more.

Closing thoughts:

In large measure, the federal revenue system is designed to transfer money from the top half to the bottom half. The federal government really is a money-distribution organization. We govern ourselves by the way we spend each others' money. How much gets spent and for what is determined by how much agreement can be reached by a majority. But whether Left or Right, whether Democrat or Republican, the only real questions of American government and governance are, "Who will be be the beneficiaries of government spending? How much shall we exact from the public for it, and by what means?"

During the 1980s, the Grace Commission was formed by President Reagan to examine to where tax revenues disappear inside the great government money maw. The commission reported that none of the money collected by income taxes paid for services. All income-tax revenue serviced the national debt. The commission said that one third of income taxes,

. . . is consumed by waste and inefficiency in the Federal Government as we identified in our survey. Another one-third of all their taxes escapes collection from others as the underground economy blossoms in direct proportion to tax increases and places even more pressure on law abiding taxpayers, promoting still more underground economy - a vicious cycle that must be broken.

With two-thirds of everyone's personal income taxes wasted or not collected, 100 percent of what is collected is absorbed solely by interest on the Federal debt and by Federal Government contributions to transfer payments. In other words, all individual income tax revenues are gone before one nickel is spent on the services which taxpayers expect from their government.

Link to the full text of the report is here.