This is a compendium of emails exchanges I had with someone I have known very well for decades, and whose opinions and counsels I trust. It began when I sent him this:

The author, Sarah Kang, whom I do not know, is a certified financial planner. This piece came up on my news feed, so I thought I'd send it to you. I argue neither for or against her conclusion, but what do you think?

The article is dated Jan. 13. It begins well enough:

With the political landscape picture becoming clearer going into 2021, it appears that two things are likely to happen. The Democrat party now has power to implement its own fiscal policies. Most likely, more economic stimulation from the government and the Federal Reserve. Unlike the Republican party, the Democratic party has little to no resistance within the party to expanding government programs and providing monetary stimulus for the economy. This means that stocks may push higher due to inflationary forces as the value of money declines steadily.

Of course, rising inflation means that any rising value of equity holdings are diminished accordingly. Her conclusion?

In fact, it is very possible that the stock market may climb higher for the next several months fueled by cash injections from the government and the Fed. However, from a prudent trade off perspective, it is going to require taking on too much risk to try to cash in with this short-term outlook.

Consider me the unpopular ski patrol who tells young “GoPro” kind of skiers not to go up on the peak of the mountain right after a big blizzard. It won’t be a popular advice until after an avalanche happens.

Looking 1~4 years ahead, the unconstrained money printing will lead to inflationary pressure along with a declining dollar value. This anticipation leads me to tweak existing investment portfolios to have a bit more position in high-quality foreign bonds, commodities, and carefully selected real estate investment trusts in lieu of long-term bonds.

My correspondent replied:

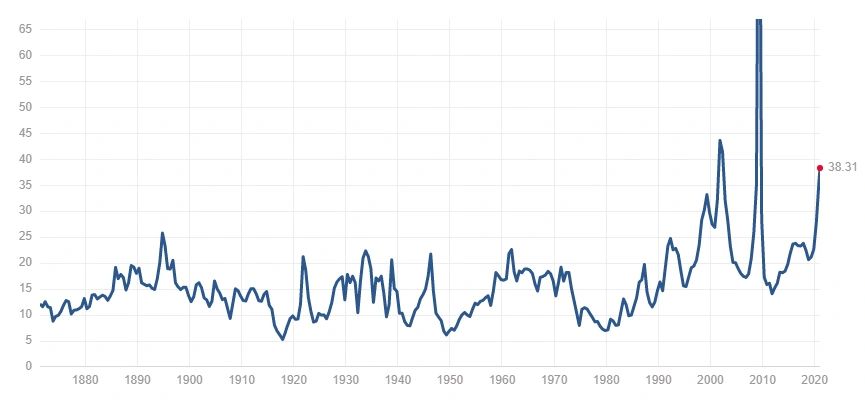

Facts are facts. The question is how to interpret them. The data shown compared to 1929, 2000, and 2008 are true. I think we are truly in uncharted waters with the government stimulus exceeding $5 trillion if Biden's $1.9 trillion package passes. It may not. There are for sure many stocks that are in a bubble where cash flow and earnings can't support the stock price -- pretty much all of those that had outsized gains in the past year (greater than 150%, maybe less in many examples). They will take a dive when interest rates rise, the vaccine gets delayed, earnings or revenue, for those that don't have earnings, a signal right there, don't meet expectations, or employment doesn't come back as fast as it is forecast.

I think there are quite a few stocks that are not in a bubble. That doesn't mean they can't go down in sympathy when the bubbles do burst but they will drop less and may be what people buy when they bail out of the bubble stocks. I am looking for more established companies that have reasonable growth prospects or that pay a good dividend, ideally both.

I also wonder at what point the degradation of American politics will begin to significantly affect the markets. The Democrat House, despite losing seats, is more determined than ever to crush "domestic terrorists," which of course really means anyone who opposes the Biden-Harris agenda. I may as well go on the record now: 2020 was the final national election of the United States as we have known it. No matter how the 2022 mid-terms turn out, the America of 2024 will be politically, formally fragmented.

The only thing between now and then that might tamp down this rising probability down is that the one thing Democrats will never stand for is open defiance to their agenda. On inauguration day, Leftist anarchists violently rioted in Portland, Ore., against the Biden administration. The feds dispersed the rioters with tear gas and violence of their own. (Just imagine Dems' reactions if it had been Trump re-elected and the same thing was done.) Remember that in 1945, Stalin ordered the execution of German communists within his zone of occupation because once in power, Leftists will never accept competition, even from ideological allies. I do not think that Antifa will have an easy time for during the next two years, although they will never be named as "domestic terrorists" like almost all significant conservative organizations will be.