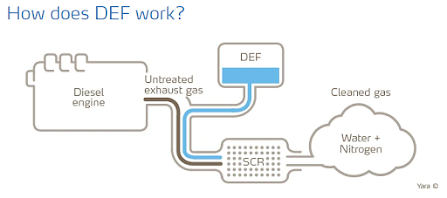

DEF is the acronym for Diesel Exhaust Fluid. Every diesel truck that has been made since 2010 is required to use it. It's a product made of 32.5% urea (made from natural gas) and 37.5% de-ionized water. DEF is kept in a separate tank in the truck and the trucks using it will not start unless the DEF system is working properly. There are regulators inside the engine that mix DEF with the diesel exhaust to reduce diesel emissions. That's the purpose of DEF.

Vehicles with SCR [Selective Catalytic Reduction] technology have a separate tank filled with DEF. This is then injected into the exhaust pipe, in front of the SCR catalyst, downstream of the engine.Heated in the exhaust, it decomposes into ammonia and CO₂. When the NOx from the engine exhaust reacts inside the catalyst with the ammonia, the harmful NOx molecules in the exhaust are converted to harmless nitrogen and water, which are released from the tail pipe as steam. (link)

The shortages our country is experiencing are making their way to diesel fuel and Diesel Exhaust Fluid (DEF). If the current shortages of mechanics, trucks, and drivers does not improve then shortages may continue to get worse, so plan ahead. ... The bottom line is that freight won’t move without DEF.

Urea is manufactured as a derivative of natural gas. The largest US manufacturer is CF Industries, which has an overwhelmingly majority share of total manufacture:

Urea is also an essential ingredient in fertilizer. Yet despite these production numbers, the United States is the world's third-largest importer of urea. Who exports it? Market Realist reports,

There's a global shortage of urea. While the ongoing supply chain issues are also to blame for the urea shortage, the situation got worse after Russia invaded Ukraine. Russia is a major fertilizer exporter and the country has banned fertilizer and urea exports.

China, which is also among the major urea exporters, has put restrictions on exports. Urea prices have surged over the last year, which is leading to high fertilizer prices. To ensure the domestic supply of fertilizers at a time when there are real risks of a global fuel shortage, countries have been looking to curb exports and prioritize domestic consumption. Natural gas is the key raw material in urea production.

Since urea is a key input for DEF, the shortage is having a negative impact on the DEF supply. Also, Europe, which is among the major DEF exporters to the U.S., is battling higher prices and natural gas shortages.

And, key point:

According to Discover DEF, “If the truck is allowed to run out of DEF, the engine's power is reduced, a solid red warning will be displayed and the vehicle speed will be limited to 5 mph until the DEF tank is refilled.” If the DEF shortage gets worse, it could ground commercial fleets since they mainly run on diesel.

So: US urea imports are falling, US DEF imports are falling. And US domestic manufacture of DEF is likewise falling and may very quickly turn critical. But what about consumer sales? How will that be affected? Let's connect some dots. Here is dot one, Flying J and the Union Pacific railroad:

Flying J sells 30 percent of ALL the DEF consumed in the United States.

According to Ken Cameron’s excellent article, Flying J gets seventy percent of its DEF via Union Pacific Railroad. Due to distribution points controlled by Union Pacific, Flying J cannot go to another supplier. Union Pacific is in control. In April, Union Pacific told Flying J to reduce its shipments of DEF by 50 percent, or else they would be embargoed, which would effectively bankrupt Flying J.

If this ultimatum is enforced, Union Pacific’s restrictions on Flying J will cause shortages, since this would cut the national supply of DEF by 15 percent. In his testimony, Mr. Konar explained that a single rail car provides 3000 trucks worth of DEF fills (2.7 gal DEF/ per 100 gal of diesel). Every missed rail car will reduce trucking potential by 5 million miles!

Remember that the trucks will not run if their DEF tanks run dry. DEF is sold through the same pumps at fuel stations as diesel fuel is. If a driver cannot fill both tanks, he can only park the truck.

|

| As you can see, Union Pacific's railway system is the largest in the United States. |

This whole situation is very odd, to wit:

- Why would Union Pacific demand Flying J to reduce its shipments of DEF by 50 percent or face embargo? Doesn't U.P. make money hauling DEF for Flying J?

- What is Union Pacific's business upside of this demand?

- As well, did U.P. consult with CF Industries or DEF makers before issuing the edict to F.J.? If F.J. cancels 50 percent of its DEF orders, would that not affect CF and DEF makers?

- For that matter, why did Union Pacific issue the edict to Flying J at all, when FJ is just the consumer, not the shipper?

Dot two: what does urea manufacturer CF Industries and the Union Pacific railroad have in common? They are both heavily owned by BlackRock, Inc.

- BlackRock is the second-largest holder of CF stock. What that means is that basically BlackRock has near-controlling influence over manufacture of all urea production and urea products in the United States because of CF Industries' dominance in the field.

- BlackRock is also the second-largest shareholder of Union Pacific, owning 7.3% of common stock.

- The Vanguard Group, Inc. is the largest shareholder of both companies, owning 8.5% of shares of Union Pacific and 12.37% ownership of CF Industries.

- And Vanguard is also the largest shareholder of BlackRock, Inc, holding almost 8 percent of shares. The second-largest owner of Blackrock, Inc., is BlackRock Fund Advisors, which means that Blackrock itself occupies that position.

Dot three (Updated): Who owns Vanguard? According to its web site, "Vanguard isn't owned by shareholders. It's owned by the people who invest in our funds." In that sense, it is like New York Life, which is a mutual company; it is the same idea as a co-op or credit union.

There is a unrelated company called American Vanguard Corp. It is agriculture oriented. BlackRock is the largest shareholder of AVC, so it is east to confuse this Vanguard with the investment Vanguard. But there is no relationship between the two.

But one question is whether BlackRock holds Vanguard investment funds, and if so, what percentage? That is a difficult question. In Vanguard's prospectuses there is a section called the "Statement of Additional Information." In this, the company is required to disclose the identity and address of holders of 5% or more of a fund's shares. However, this disclosure is only done fund by fund. By far, the largest investors in Vanguard funds are institutional investment companies, mainly 401(k) and other retirement holdings. How much, if any, of Vanguard's funds are owned by BlackRock would be a very time consuming process to learn.... a concern could be that the two companies “may not accurately represent client preferences” when voting in invested companies on their behalf. She also acknowledged that both “try to be transparent in how they vote (by) publishing this information”.

As company shareholders, BlackRock and Vanguard can vote on behalf of their clients at company shareholder meetings. Both firms also have “investment stewardship” functions, which enables the proxy votes.

Which is to say, the proxy stewardship function means that the investor-owners must be very proactive or even aggressive is they want to determine how their votes will be tallied to set Vanguard's policies. And even if some or many investor-owners are that proactive, if BlackRock owns large shares of Vanguard funds, proactive investor-owners will be far outvoted by BlackRock proxy-voting on behalf of vastly larger numbers and share values of other, passive, investor-owners.

But we do not know whether that is happening.

So here is the dot connection:

- CF Industries is the overwhelmingly dominant maker of urea in the United States. Urea is the key component of DEF.

- CF Industries' two largest shareholders are Vanguard and BlackRock.

- Flying J sells almost a third of all the DEF sold to truckers in the country. It obtains 70 percent of that DEF from shipment by Union Pacific railroad.

- Union Pacific has mandated that Flying J reduce its shipments of DEF by 50 percent, or else they would be embargoed, which would effectively bankrupt Flying J.

- Union Pacific's two largest shareholders are Vanguard and BlackRock.

The policy, strategy, and plans division of BlackRock is the BlackRock Investment Institute.

The BlackRock Investment Institute (BII) leverages the firm's expertise and generates proprietary research to provide insights on the global economy, markets, geopolitics and long-term asset allocation – all to help our clients and portfolio managers navigate financial markets.

And:

- The Chairman of the BlackRock Investment Institute is Tom Donilon, President Obama’s former National Security Advisor.

- Tom Donilon’s brother, Mike Donilon is a Senior Advisor to Joe Biden.

- Tom Donilon’s wife, Catherine Russell, is the director of the White House Presidential Personnel Office.

- Tom Donilon’s daughter, Sarah Donilon, graduated from college in 2019 and now works on the White House National Security Council.

In February, CNBC reported, "Biden pauses new oil and gas leases amid legal battle over cost of climate change." And Politico reported that the number of oil and gas permits approved by the Bureau of Land Management for drilling on public lands declined to its lowest number under the Biden administration this year. So how does that affect the supply of natural gas to use to make urea?

According to the federal Energy Information Agency, in 2020 the US produced 111.2 billion cubic feet per day of nat-gas. In 2021, it was 118.8 billion cubic feet. The EIA forecasts 2022 thus:

U.S. natural gas inventories ended May at 2.0 trillion cubic feet (Tcf), which is 15% below the five-year average. We forecast that natural gas inventories will end the 2022 injection season (end of October) at just over 3.3 Tcf, which would be 9% below the five-year average.So natural gas production is falling. What about infrastructure? Reuters, last month: "U.S. natural gas production growth wanes as need arises."

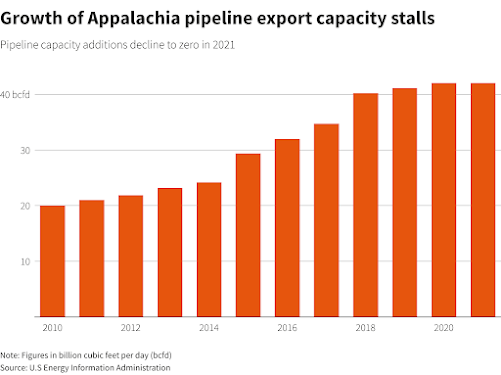

For much of the past decade, Appalachia has been the workhorse of U.S. gas production, growing by an average of 36% per year from 2010-2019.

Pipeline construction has slowed, and output growth dropped to an average of 4% in 2020 and 2021. EQT Corp (EQT.N) said on its earnings call that growth will not pick up until there are more pipelines.

Appalachia "is nearing takeaway capacity limits," said analysts at Bank of America, who estimated there would be "little to no production growth" until new pipes enter service. ...

Another long-delayed project, Equitrans Midstream Corp's (ETRN.N) $6.2 billion Mountain Valley line from West Virginia to Virginia, has not been completed due to ongoing lawsuits.

"This project may be the last large greenfield natural gas pipeline to go into service east of the Mississippi River for some time," said analysts at ClearView Energy Partners, who estimate Mountain Valley will enter service in mid 2023.

America's largest gas field is the Permian Basin, but, "Permian gas output grew by an average of 17% per year from 2012-2020, before slowing to just 8% in 2021" (Reuters).

The Finale:

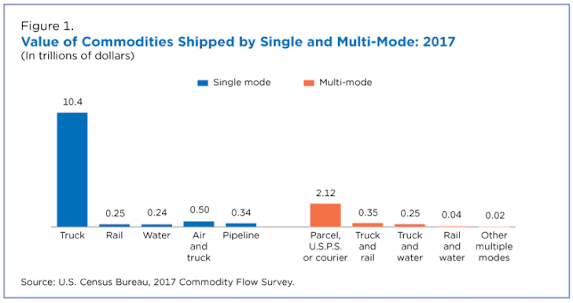

Unless the nation's truckers can refill with Diesel Exhaust Fluid, the trucks will stop. Literally. DEF production and imports are about to crater and the country's largest truck-fueling company, Flying J, has been directed by Union Pacific railroad to decrease its DEF-receiving shipments by 50 percent or be 100 percent embargoed. Unless resolved, this demand may cause countless thousands of 18-wheelers to be force-parked very soon, perhaps starting this month. That would be a very, very terrible event, because according to the federal Bureau of Transportation Statistics, the trucking industry transports almost three-quarter of all goods shipped in the country:

Union Pacific's largest two shareholders are Vanguard and BlackRock. BlackRock's key figure for strategy and policy is Tom Donilon, President Obama’s former National Security Advisor. Donilon's wife, daughter, and brother work at the Biden White House.

There is no wand to be waved to make the DEF shortage simply disappear. But doing nothing is both reprehensible and indefensible. There is no one better positioned to bring this looming catastrophe to the front burner than two men and two women named Donilon. Yet nothing is exactly what is being done. Why? Well, draw your own conclusions:

A Knoxville friend writes: “Ha, Rural King literally had pallets of 2.5 gallon DEF containers in their stores. $6.99, then $9.99. Now none. Same at Walmart. Tractor Supply etc. All of the newer ag equipment, tractor’s, combines etc require DEF. Talk about food shortages!”We just need a hack so it’ll run without it. But EPA will probably block this. I liked it better when Atlas Shrugged was just a novel.ANOTHER UPDATE: They were warned this was coming 6 months ago: The DEF Shortage – As Prices Rise, Supply Challenges Continue.